Robust Price-setting Newsvendor Problem

|

Topic: |

Robust Price-setting Newsvendor Problem |

|

|

Time&Date: |

10:30-11:45 pm, 2019/8/29 (Thursday) |

|

|

Venue: |

Room 619, Teaching A |

|

|

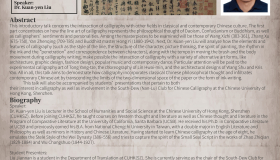

Speaker: |

Prof. Ye Lu (University of Science and Technology of China) |

|

| Abstract: |

The price-setting newsvendor problem is well studied in the literature. However, it is commonly assumed that retailers have complete demand information modeled as a function of price and random noise. In reality, a retailer may have very limited information on a demand model because a retailer who has exercised only a few prices does not have sufficient information to accurately estimate a demand model. This creates a gap between academic research and practical applications. In this talk, we consider the price-setting newsvendor problem in which the retailer knows the expected demand on a few exercised price points and the distribution of the random noise. Both additive and multiplicative demand models are studied. The retailer makes price and inventory decisions to minimize the maximum regret, defined as the difference between the expected profit based on limited demand information and the expected profit based on complete demand information. We show that this robust optimization problem can be reduced to a one-dimensional optimization problem, and derive the optimal price and inventory decisions. We also provide a demand learning policy that can reduce the minmax regret to any δ within O(1/δ) steps. Extensive numerical studies show that our method has a great performance that dominates those of regression methods. |