Meet With Nobel Laureate In Economic Sciences—Myron Scholes

The distinguished professor and Nobel Laureate in Economic Sciences, Myron Scholes, met SME students at the board room, Daoyuan building on November 21.

Prof. Michael Ferguson, Executive Associate Dean of SME, Prof. Marlene Amstad, Assistant Professors Huang Zongbo, Liu Hongqi and Liu Zhuang, were also present. Two groups of senior undergraduate students--Wei Sili, Wu Hongyu, Ren Baiyong, and Wang Weiyu presented their research projects in the areas of finance and economics respectively. More than 200 undergraduate and graduate students came to join the conference.

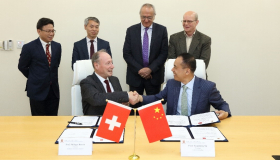

First, Prof. Scholes and Shenzhen Finance Institute's Executive Associate Dean Prof. Liu Ming congratulated the MSc in Finance Program for their excellent academic performance. The Dean’s List certificates were awarded to them by Prof. Scholes.

Then, Prof. Scholes gave a keynote speech. He recalled that he was born in a small Canadian town where he already showed great talent at a very young age, which was why his parents moved to Toronto with him to further his education. In college, as an Economics student, he was impressed by works of George Stigler and of Milton Friedman. After graduation, he pursued his Ph.D. at the University of Chicago. He emphasized the importance of following the heart and to pursue one’s own interests. However, if you followed the mainstream blindly, you would easily lose your way.

Prof. Huang Zongbo hosted the undergraduate research sharing session. Wei Sili, Wu Hongyu, and Ren Baiyong presented their research project "Investor Attention and Stock Returns--Evidence from Extreme Market Conditions." They quantitatively analyzed the Chinese stock market's performance during the period when the Circuit-Breaker Mechanism was triggered. The result showed that investor attention was positively correlated with stock price.

Wang Weiyu presented her research "Does Decentralization Always Lead to Economic Growth? Evidence from the Micro-lending Sector in China." Her quantitative research revealed that in provinces, "conflict rules" eased the regulations required by the central government and thus promoted the micro-lending industry's growth. "Expansion rules" strengthened local government's power and slowed down such growth.

Prof. Liu Hongqi commented on this research. She gave the example that the Chinese TV drama Ode To Joy boosted the stock price of Hongxing Fazhan (600367.SH), simply because this name coincided with a fictional company's in the drama. The reputation of major stock holders could influence individual Chinese investors' behavior and pushed up stock price. She also suggested that researchers to extend the sample's range, explore the subsequent effects, and study how investors' attention's impact on stock price during the bull market and bear market differently.

Wang Weiyu presented her research "Does Decentralization Always Lead to Economic Growth? Evidence from the Micro-lending Sector in China." Her quantitative research revealed that in provinces, "conflict rules" eased the regulations required by the central government and thus promoted the micro-lending industry's growth. "Expansion rules" strengthened local government's power and slowed down such growth.

Prof. Liu Zhuang commented on this research and elaborated on the factual background, and pointed out the uniqueness of China's current stage of economic development.

After the presentations, Prof. Scholes discussed the research data, research methods, and external factors with the young researchers. Moreover, he affirmed that the projects both had practical significance under the current economic context of China and gave some suggestions to the undergraduate students.

Q: From your biography, we have learnt that you like gambling to understand probability and risk. Do you still gamble to understand probability and risk?

A: Good question. I guess basically that I still believe to this day that people stay a lot more around what other people expect them to do, and stay close to the heart, and don't deviate very much from it—as much as they should. So what I mean is a greater chance of creating something and going through the bamboo forest to just go along the same route all the time, without ever going to the right or left. When I think about risk, I think that people really try to stay too much in the middle and not go off in the other directions. Uncertainty is the very nature of my field, as I understand it. I gambled when I was young. I do so today but I try to create a distribution [that] was asymmetric, you know, having great upside than I have downside potential.

Q: According to your biography, it was difficult for you to read for an extended period during the age between 16 and 26. You said that you learned to think abstractly and to conceptualize the solution to problems. Could you elaborate more on this?

A: When you have difficulties in thinking, okay, then you have to listen very attentively what other people are saying and figure out a way to internalize what they're saying and think about it. And then I felt that enabled me to be able to see things much more broadly, you know, that just it wasn’t an easy route as well. Sometimes when you only think about in your own self and do things you don't listen other people and what they're saying, you can miss a lot. So what I have learned to do, was to really concentrate and think deeply about various things, then I was able to attack problems to enjoy thinking about things that… just thinking about things. letting myself learn supposed to memorizing steps in this learning.

Q: About 40% of students from our school major in Finance. Some of them want to further their study with a master or a PhD, while some want to go to work. Between these two options, do you have any advice to our students?

A: Personally involved, I mean getting a PhD and working in a PhD is lonely, you know. You have to want to do a lot of work on your thesis, and get it done, and the like. I would think that, basically, if we have the inclination to do that, it's always good to have the potential that you want to be alone and do those types of projects. But some people just prefer to go and get the MBA or get a master's degree and go off to work, and various things. But I also say that it depends on the individual, whether they have finished and have learned enough, you know, to do it, to get off and do it on their own. I don't know the answer to that. It depends on the person and what they want to do. And when I was thinking of getting my PhD, there wasn't anything in business that you want to do other than teaching, because there wasn't a competition with great things you could do, so I don't know maybe if I were doing it today I want to go off sooner than getting my PhD. I was trained at that time to get my PhD and be a professor. But nowadays there are so many different options: you get your PhD, and then go up into business, and work in business, or go into teaching, anyway you want to do. So you know, it depends on the individual.